Welcome to the Chalten Investment Review for Q2 2023. Global stock markets gained again in Q2, led by the US stock market and especially US technology stocks. Bond returns remained flat, with the US Federal Reserve pausing rate hikes in the face of slowing inflation while other Central Banks (including Canada) continued to raise rates.

In our Q1 Investment Review we reminded investors of three time-tested principles: 1) Uncertainty is Unavoidable, 2) Market timing is Futile and 3) “Diversification is your Buddy” (a quote from Nobel Laureate Merton Miller). The phrase we often hear is that having a good long-term investment experience is more about “time in the markets” rather than “timing the markets”. A recent article by David Booth reminded us of the potential rewards for “time in the markets”. With the power of compounding, even small amounts set aside each year for investment can lead to impressive wealth accumulation over long periods of time.

This time of year we think of young people graduating from high school or university or maybe taking on a part or full time job during their summer break. In Canada you start accumulating TFSA contribution room at age 18 (although in BC you can’t actually open a TFSA account until age 19). The current annual contribution allowance is $6,500 for 2023 and is supposed to increase in $500 increments over time with inflation. Investment earnings are tax-free and withdrawals are tax free. Although the TFSA presents an incredible opportunity to build long-term tax-free wealth for young people, many Canadians still don’t understand the account or don’t use it to its full potential. According to the 2022 BMO Annual Savings Study, 49% of Canadians with TFSA accounts still believe the TFSA is only for cash savings and 56% of TFSA holders only hold cash in their TFSA accounts. This represents a lost opportunity, especially for young investors with years of potential tax-free compound growth to look forward to!

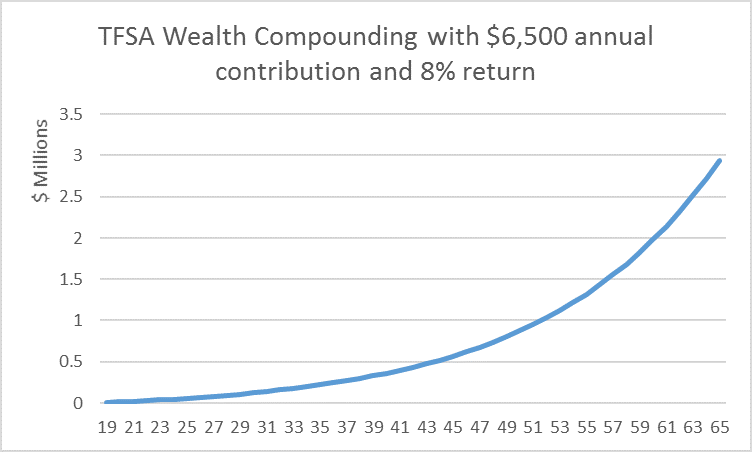

To illustrate this power, let’s consider a 19 year old university student, cash in the bank from toiling through a summer job, fresh from suffering through a “Wealthy Barber” style lecture from their “wise old” parents. They begrudgingly commit to financial discipline and agree to contribute $3,250 of their earnings each year to a new TFSA account. The parents agree to match for a total of $6,500, the 2023 annual contribution limit. Let us further assume this happens every year through normal retirement age of 65 and that the CRA freezes the annual contribution amount at $6,500 because too many Canadians have wizened to this great tax-free compounding opportunity. Stocks are a great investment to hold in a TFSA because they deliver higher growth than bonds or GICs and over time that growth adds up! The long-term average stock market return is about 10%. To adjust for inflation of 2% (to illustrate our savings in constant units of purchasing power) let’s assume an 8% return.

So with $6,500 invested per year at 8% tax-free, what can this TFSA do for our committed young investor? Here is what the account could be worth a various points if left alone (the key is to leave it alone!)

Age 25: ($41,000) – New jeep? Pay off those student loans?

Age 30: ($117,000) – Executive MBA tuition? Sports car?

Age 40: ($354,000) – Really? This is starting to add up!

Age 50: ($866,000) – Maybe time to go mortgage free?

Age 55: ($1.3 million) – Hold on a second, do I really have to keep working to age 65?

Age 65: ($3 million) – Sure glad I listened to my “wise old” parents 45 years ago…..

Compound tax-free growth is a beautiful thing! Remember…..”Time in the market”…….

Q2 Market Review

In the US, there were signs that inflation is moderating and the Federal Reserve felt comfortable keeping its benchmark rate stable although most forecasters still predict two more rate increases before this rate cycle is complete. Inflation came down to an annualized 4% in June. The European Central Bank, on the other hand, did raise rates twice over the quarter and inflation remained at 5.5% in June. The Bank of Canada raised its benchmark rate in June to 5%, the highest level since 2001.

Generally, stock markets were positive over the quarter, with relative strength in the US market. The technology heavy Nasdaq index delivered its best first half of the year since 1983, up nearly 40%. Emerging markets lagged, led by particularly weak performance in Chinese stocks.

In Q2, large cap stocks outperformed small cap stocks everywhere but in emerging markets. Growth outperformed value in Canada and the US but value outperformed growth in international developed and emerging markets.

- Total return for the Canadian stock market was 1.1% for Q2 2023 and 5.7% for 2023 year to date.

- In the US, the total net return of the S&P500 in Canadian dollar terms was 6.3% for Q2 and 14.0% for 2023 year to date.

- The total net return for the S&P Global ex-US BMI Index of stocks outside of the US (in Canadian dollar terms) was 0.3% for Q2 and 6.6% for the year to date.

- The Canadian dollar gained 2.2% against the US dollar over the quarter and is up 2.3% in 2023 so far.

- Total return for Canadian bonds was -0.6% over the quarter and 2.2% for 2023 year to date. Global bonds were relatively flat during the quarter and emerging market bonds were positive.

Financial Planning topics of interest

With the Bank of Canada increasing its benchmark rate once again to 5%, borrowers with variable rates might find their mortgage payments going up. Banks can help alleviate pressure by allowing “payment holidays” or extending amortization periods. Just make sure any options being presented are truly in your best interest rather than an opportunity for the bank to offer you new products that are in their best interest.

Financial frauds and scams are on the increase and fraudsters are always thinking up new ways to steal your money. Technology has completely transformed the criminal landscape, making fraud easier to commit, more widespread, and more sophisticated than ever before. According to the RCMP, the Canadian Anti-Fraud Centre received fraud and cybercrime reports totaling $530 million in victim losses in 2022, a 40% increase over 2021. These were just the ones reported. Please be vigilant every day when answering the phone, dealing with strange emails and using credit cards. We all think we know what a scam looks like but it’s always possible to be caught off guard!

_______________________________________________________________________________

In closing, we invite those of you “wise old” investors to take the opportunity to teach a young person about the power of compound interest and for everyone to remain alert for fraudsters as they get more and more sophisticated and aggressive.