We and many others spend a lot of time and effort trying to educate people about the importance of keeping costs low as part of a sensible long term investment strategy. The evidence of the importance of costs is so overwhelming that you really have to take your hat off to the marketing departments and sales forces of the Canadian mutual fund companies, banks and other advisors selling high-fee and inefficient investment solutions for overcoming this evidence.

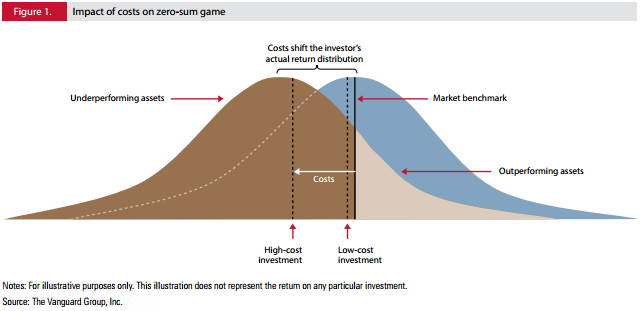

The underperformance of active funds (those that try to beat the market by either making market-timing bets or by stock-picking) is mainly due to the fact that they charge higher fees than passive or index funds (those that try to deliver market-like returns). Fund management is effectively a zero sum game. This was highlighted very nicely a long time ago (1991) in a concise paper by Nobel Laureate Bill Sharpe:

“If “active” and “passive” management styles are defined in sensible ways, it must be the case that

(1) before costs, the return on the average actively managed dollar will equal the return on the average passively managed dollar and

(2) after costs, the return on the average actively managed dollar will be less than the return on the average passively managed dollar

These assertions will hold for any time period. Moreover, they depend only on the laws of addition, subtraction, multiplication and division. Nothing else is required…….To repeat: Properly measured, the average actively managed dollar must underperform the average passively managed dollar, net of costs. Empirical analyses that appear to refute this principle are guilty of improper measurement.”

In the words of WSJ columnist Jason Zweig, “Over the long-term the superiority of indexing is a mathematical certainty.” In other words, fund management is a zero sum game. The chart below from Vanguard illustrates this point.

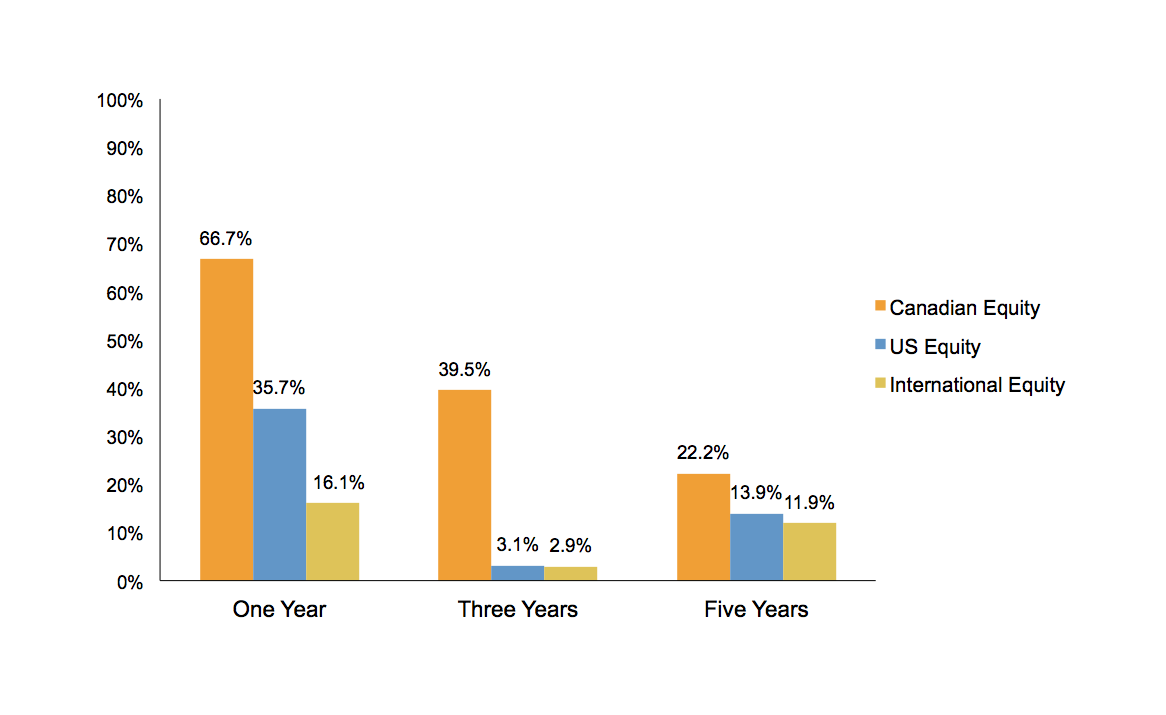

Not only does the average active fund have to underperform the market and passive funds by the amount of fees charged but, overtime, most individual funds will underperform the market and it is nearly impossible to determine in advance which very small proportion of funds will survive and be one of the few outperformers. The following chart from Dimensional Fund Advisors using data from the Standard & Poor’s Indices Versus Active Funds Canada Scorecard, Year-End 2013 shows the percentage of Canadian mutual funds that outperformed the market over one, three and five year periods.

This data is not new nor is it hard to come across, and you get similar results looking at different time periods. In fact all of this data is continually highlighted in the financial press in Canada – so it’s amazing to us that the adoption of low cost index funds and ETFs is still so small in Canada compared to other countries. Why? Because a lot of people make a lot of money selling active fund management and while the funds and strategies sold by many banks, mutual fund companies and other advisors are poor performers, their sales and marketing tactics are great performers! In fact the securities regulators in Canada are so concerned about the ongoing duping of the retail investor (you and I) that they are considering fairly severe measures to curtail certain selling practices and charges. I wish rather than relying on protection from regulators that Canadians would simply choose the better alternatives currently available on the market and force more of the expensive underperforming alternatives out of the market but somehow we continue to be fooled and the regulator feels they have to step in for our own good. So be it, we need help. As Vancouver Sun reporter Don Cayo put it in an article earlier this year, “The bottom line — my words not Morningstar’s — is these funds actually tell us what they’re going to do to us, then go ahead and do it when we give them our money anyway.”

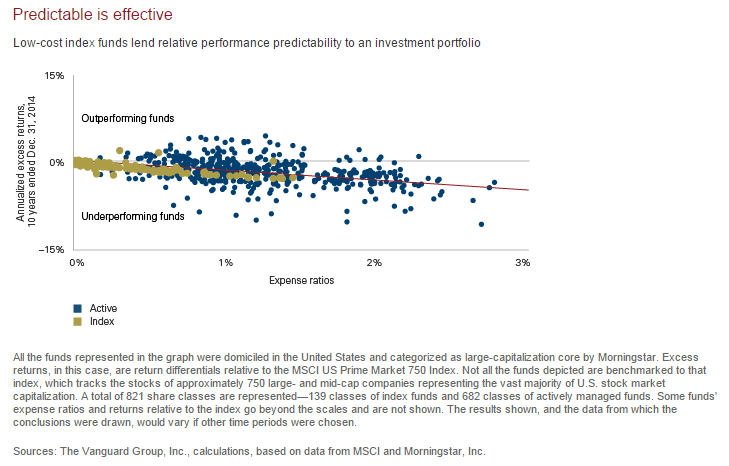

And the underperformance is only half the story – the return side of the story. The important other side of the story is that with index funds you not only get higher average investment performance over time, you get it with near certainty. By definition, index funds give you the market return. Of course tracking error and some costs means you may deviate slightly and some index fund / ETF providers are better and lower cost than others but you can generally be comfortable that you’ll get very close to the market return. With active funds you not only have to accept lower expected returns, you have to accept the risk that you won’t even get that! The following chart from Vanguard illustrates this quite nicely.

As fees go up for both index and active funds, returns relative to the market go down, but at least with index funds the relationship between costs and returns is fairly well defined and predictable. With active funds you still have to face the fact that you could underperform the market substantially. When it’s nearly impossible to tell in advance which funds will outperform, this presents additional and unnecessary risk. Hardly anybody talks about this – a fair amount of google searching got me a lot more evidence on average returns but not much on the impact of return dispersion. Good old Vanguard to the rescue again!

John Bogle, Vanguard founder, says, “What happens in the fund business is the magic of compound returns is overwhelmed by the tyranny of compounding costs. It’s a mathematical fact.”

The other side of the story is that what happens in the fund business is not only do you get lower average returns but the added risk that you could do even worse.

So again we give you our evidence-based principles:

- Passive funds outperform active funds in the long run

- Diversification is important

- Asset allocation should be based on risk tolerance and a disciplined rebalancing strategy

- Keep costs low

Don’t get duped!

Please subscribe to the Chalten Blog to have these insights delivered directly to your inbox!