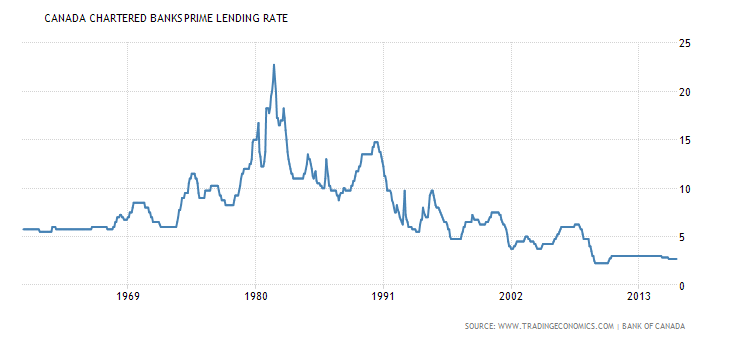

In the early 1980’s the prime lending rate peaked at over 20%. Since then the trend in the main benchmark rate in Canada and other developed economies has generally been down, leading to strong price returns in bonds over that period.

With some fairly memorable bumps along the way stocks have also performed quite strongly over the same period. As a result, any well diversified balanced portfolio has done well over the long term. In fact there has been less performance difference than you’d think between a bond heavy balanced portfolio and one that’s stock heavy.

So now that global stock indices are at record levels and interest rates near record lows, what can we expect for future returns? This month McKinsey and Co. published a report suggesting that investors may want to temper their return expectations going forward for the following reasons:

From Why investors may need to lower their sights | McKinsey & Company