The core principle of an evidence-based approach is that risk and return are related. The remaining principles of the evidence based approach flow from this core principle. In the fourth installment of our series on Evidence-Based Investing we presented some of the evidence which demonstrates that asset allocation should be based on risk tolerance and disciplined rebalancing. In this fifth and final installment we focus on costs.

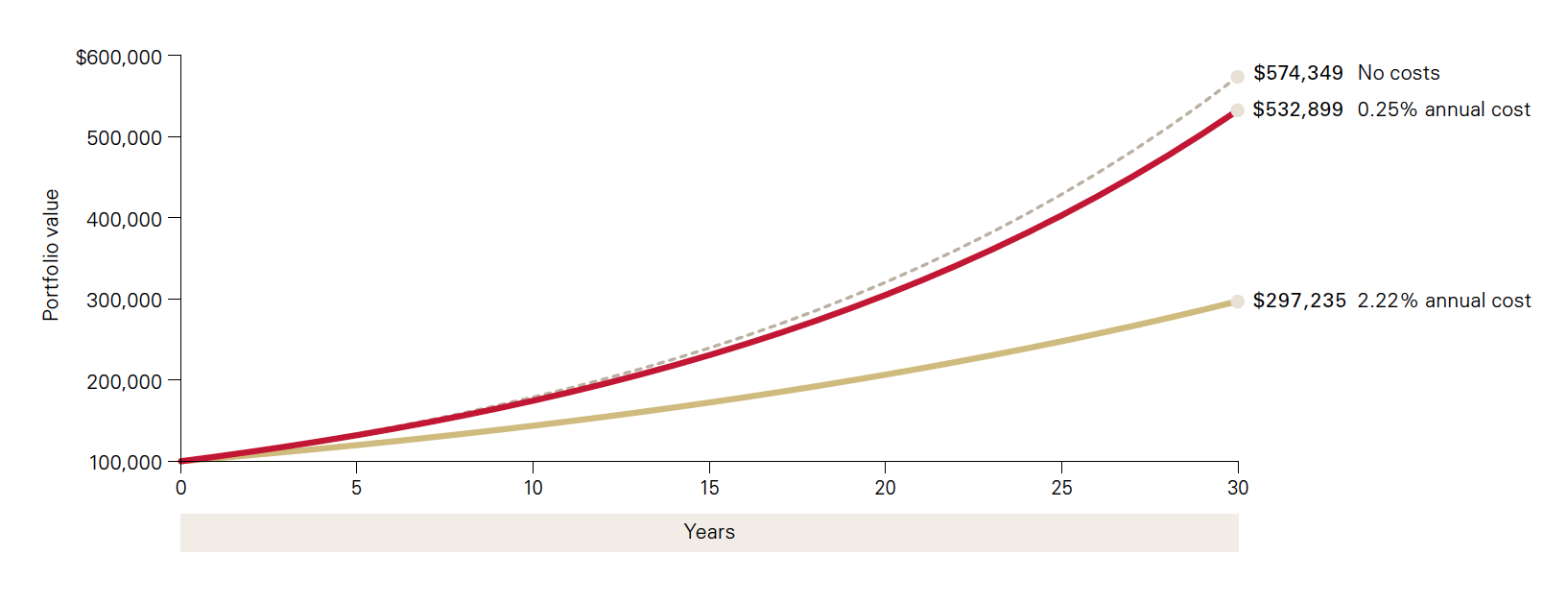

Costs have an enormous impact on investment returns. If investors choose to diversify by investing in mutual funds they will have to pay the cost of the mutual fund provider. The costs associated with a mutual fund are collectively known as the Management Expense Ratio or “MER”. This group of costs usually includes a management fee to pay the fund manager, all the administrative costs of the fund, the fund’s trading costs and brokerage commissions as well as any commissions paid to the people who sell the funds to investors. MERs can range from 1/10th of 1% or less for some passively managed index funds to higher than 3% for some actively managed funds. Canada has some of the highest MERs in the world. The chart below from Vanguard illustrates the effect of costs on investment returns over time. Without costs, an annual return of 6% would turn $100,000 into $574,349 over 30 years. Add an MER of something similar to what Canadians pay on the average stock fund and the $574,349 is reduced to $297,235 over the same time period. The impact of the costs is significant.

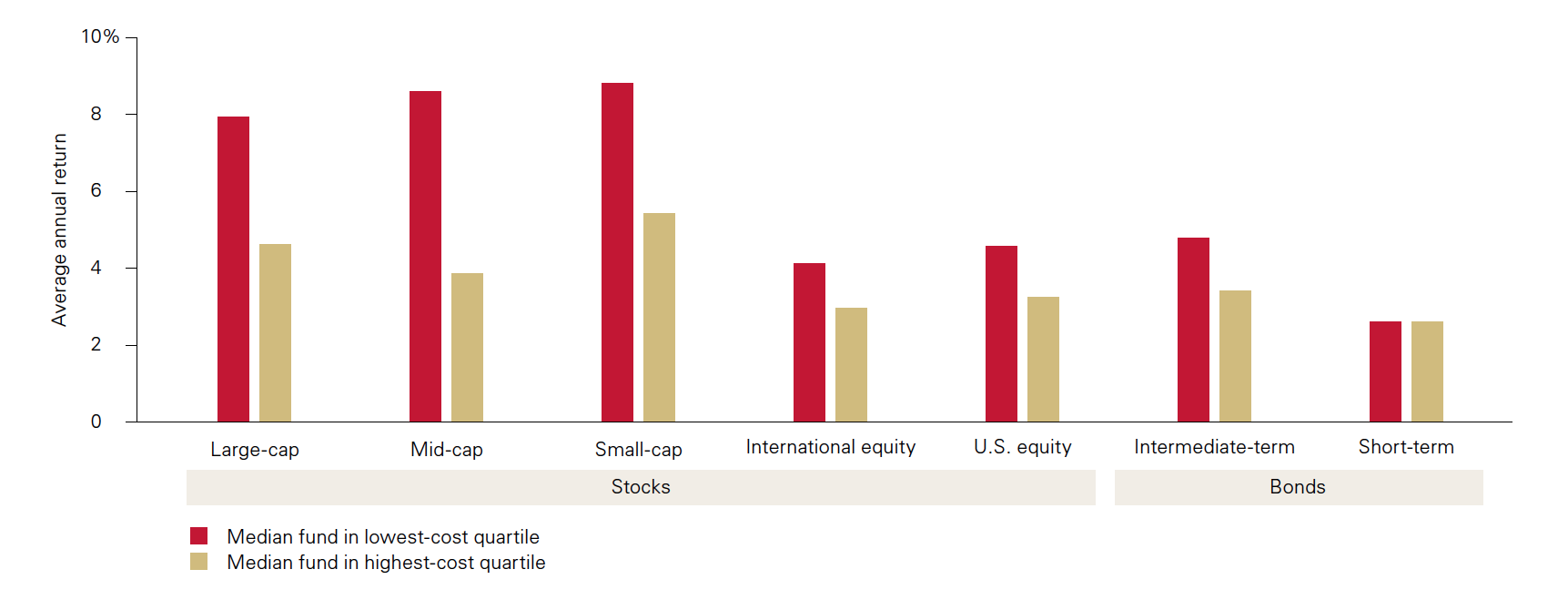

But shouldn’t paying higher fees lead to higher performance? Presumably paying higher fees means you’re paying more for a high quality fund manager. The evidence suggests otherwise. There are many studies that show that the strongest, in fact the only, predictor of future fund performance is costs – the higher the costs, the worse the performance. The following chart from Vanguard and Morningstar showing median fund returns in the lowest and highest cost quartile illustrates this point.

Irrespective of asset class, higher fees lead to lower performance or as the author of the great book “A Random Walk Down Wall Street” Burton Malkiel said, “The surest way to find an actively managed fund that will have top-quartile returns is to look for a fund that has bottom-quartile expenses.”

Finally, active fund managers may also trade their portfolios more frequently (high turnover) than managers of passive investment funds who generally trade less frequently (low turnover). High turnover has greater tax consequences than low turnover which will also likely detract from investment performance.