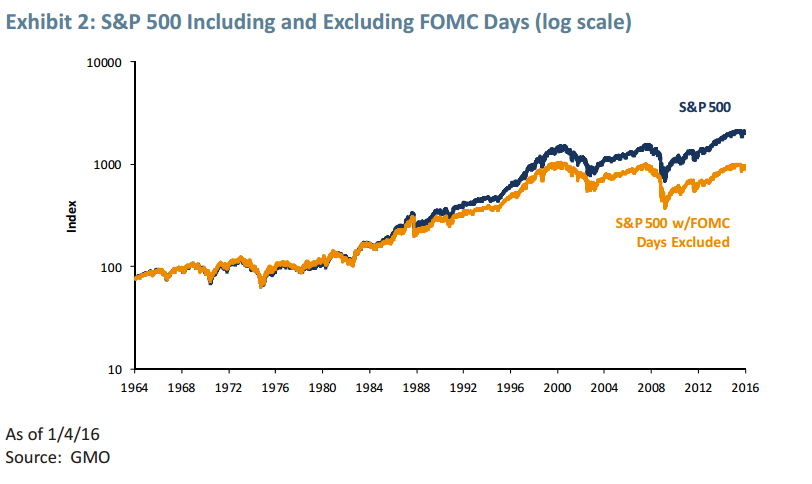

It seems these days that every time the Federal Market Open Committee (the branch of the Federal Reserve in the US the sets monetary policy) meets, the entire world sits waiting on the edge of their seat. It’s almost like we’ve come to believe that monetary policy is the only thing left driving stock returns and that without the liquidity the feds in the US and around the world occasionally inject into the system global stock markets would simply run out of steam and veer towards the Armageddon scenario that’s been stalking us in our nightmares since the last big crash in 2008/2009. Some new research out by the smart folks at GMO (Grantham, Mayo, Van Otterloo & Co.) suggests this is the case. It turns out that since 1984, 25% of the total return of the S&P500 index has come on days when the FOMC made an announcement. The average daily return of the index is in fact 29 times higher on announcement days than normal market days – pretty compelling evidence. The chart below from the research shows the performance of the S&P500 (in log scale) with and without FOMC days.

Given the time frame we’re looking at one would think a generally declining interest rate environment would mean the market clearly likes FOMC announcements to drop interest rates (ease monetary policy). But you see there’s a twist. Their evidence shows that while there is a significant impact of FOMC announcements on market returns, the difference between announcements to lower rates or raise rates was insignificant. In other words, it doesn’t matter what the Feds say they’re going to do, just their presence seems to give investors confidence.

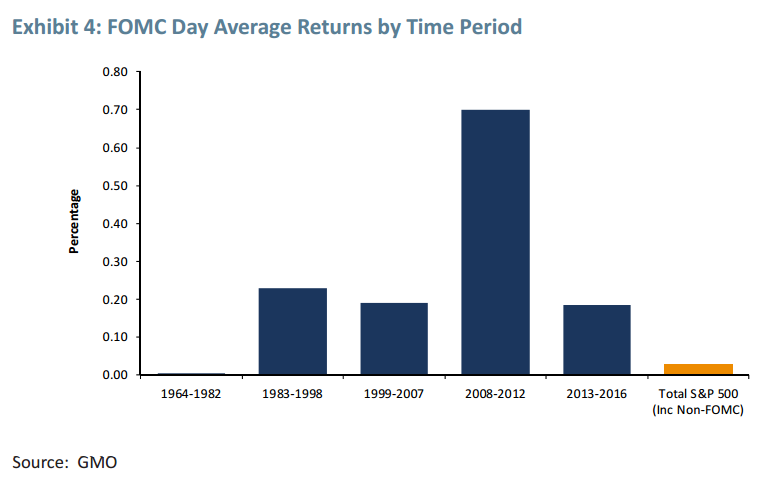

So for those that believe the omnipotent monetary authorities can wield their policy weapons and continue to save the world’s markets, this evidence may sooth. Not so fast, however, for it seems the strong impact since the financial crises is waning. The evidence also shows that while returns on FOMC announcements were very significant in the immediate years post the crisis, since 2013 the impact seems to have reverted to that observed in prior periods.

The authors suggest this indicative of “Quantitative Easing fatigue” and conclude that it might be dangerous to continue to rely on monetary authorities to drive market returns. They also leave us with a quote from Newton, “I can calculate the motion of heavenly bodies, but not the madness of people.”

People aren’t always rationale, especially when it comes to investing.