Earlier this week we wrote about the home bias many Canadians have when it comes to their investments (see Only two resolutions for Canadian investors in 2016). This home bias turned against investors in 2015 as the underperformance of the energy sector and the loonie teamed up for a double whammy hit to investors’ portfolios. For many Albertans, whose livelihoods are also tied directly or indirectly to the energy sector, it must feel more like a triple whammy.

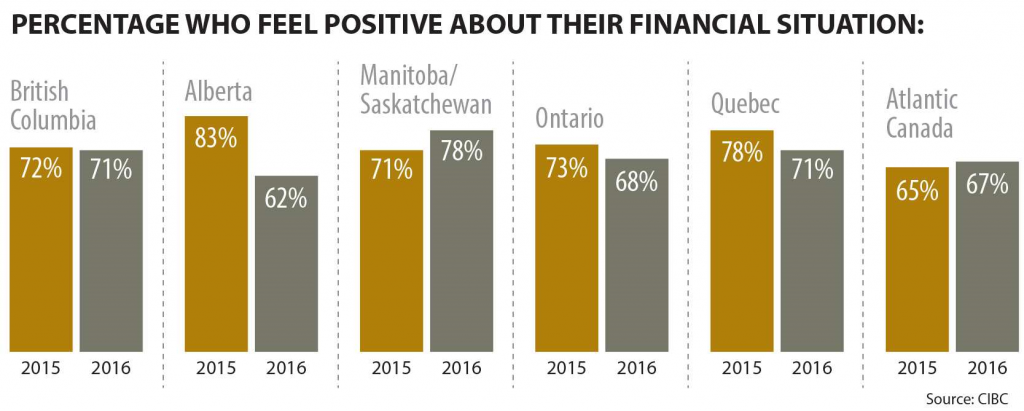

No surprise then, that Albertans are feeling a lot less confident about their personal finances. Mario Toneguzzi highlighted a recent CIBC study in his piece this week (see Albertans least confident of all Canadians about personal finances) which found that “The percentage of Albertans who feel confident about meeting their future financial goals dipped from 91 per cent in 2015 to 72 per cent this year.”

While a good investment portfolio should be very well diversified and protect you to some extent from specific risks like oil price and currency drops, unfortunately many investors are feeling precisely the opposite due to unhealthy biases in their investment portfolios. Indeed many investors have even more overweight positions in the energy sector than the already overweight Canadian stock market. Add to that less safe employment conditions, perhaps even a job loss and slower growth prospects and you can understand why Albertans might feel less confident about their ability to control their financial situation going forward.

While it may be tough to make changes to your employment situation and difficult to sit and hope for a recovery, investors can take some basic steps to make sure their investments are helping to ease their worries rather than adding to them. Ensuring your portfolio is properly diversified is number one. Number two is getting away from the high fees that many investors currently suffer and that get charged even in down markets. Lowering fees will allow you to keep more of your own money to help you get through current tough times and help you build a bigger nest egg for the future.